Frequently Asked Questions About the Merger

Pacific Premier Bank is joining Umpqua Bank to expand opportunities for businesses and consumers.

The merger with Umpqua is anticipated to be completed later this year, subject to regulatory, shareholder, and other required approvals. Until the merger closes, both banks will continue to operate independently. The following information provides answers to questions you may have about our partnership with Umpqua Bank and what this means for you. The following information provides answers to questions you may have about our partnership with Umpqua Bank and what this means for you.

Click on the questions below to view the answers.

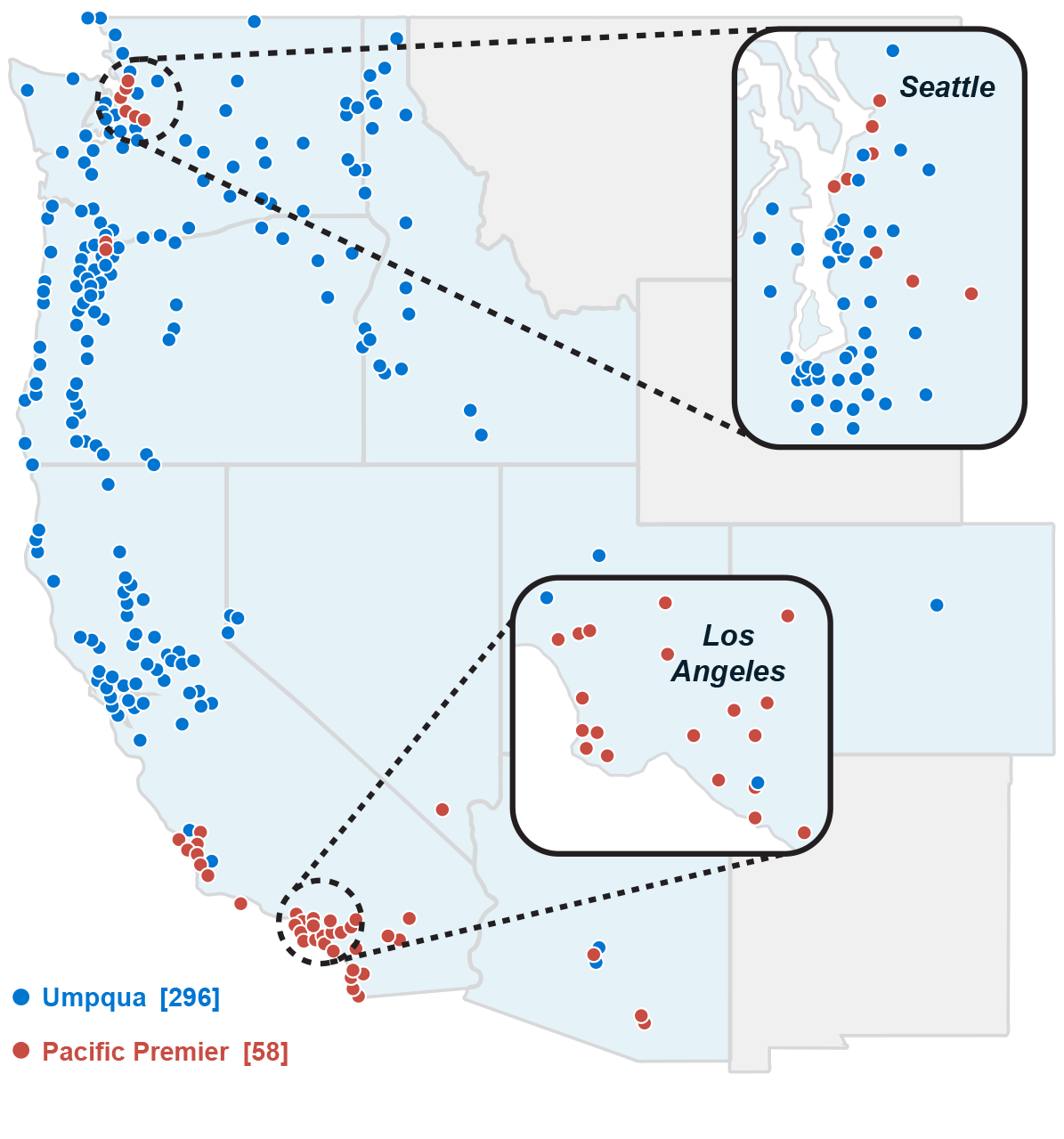

Umpqua Bank is the third largest bank headquartered on the West Coast with over $50 billion in assets and nearly 300 locations in Washington, Oregon, California, Nevada, Arizona, Colorado, Utah, and Idaho. Based in Lake Oswego, Oregon and founded in 1953, the bank serves both businesses and individuals through a relationship-focused approach, offering the personalized service of a community bank.

Umpqua offers a variety of solutions, including retail and commercial banking, SBA lending, agricultural banking, healthcare banking, institutional and corporate banking, treasury management, global payments, equipment leasing, and more. Customers also enjoy access to comprehensive investment services, wealth management expertise and private banking through Columbia Wealth Management, a division of Umpqua Bank. The bank is committed to the prosperity of the communities it serves, contributing more than $7 million annually in various donations, sponsorships and grants through its corporate giving and the Umpqua Bank Charitable Foundation.

Please visit the homepage at UmpquaBank.com.

As part of Umpqua Bank, you will have access to a variety of new services while continuing to enjoy the deep expertise of local bankers and a network of locations that spans the West. Umpqua brings additional leasing expertise and solutions, a broad array of treasury management and fraud protection services, home loans, as well as a comprehensive assortment of personal and business wealth management solutions that include private banking, investments, insurance and fiduciary trust services through its Columbia Wealth Management division. Additionally, the size of our combined institution will provide greater lending capacity for our bankers. You will be able to grow comfortably with us while enjoying the same relationships with the bankers you know and trust.

Many new Umpqua Bank services will be available immediately following the close of the merger. However, some services are tied to Umpqua’s operating systems and will become available when our bank systems and services convert to those offered by Umpqua Bank, which we expect to occur in early 2026. Our bankers will introduce you to these new services and discuss which solutions could help support your business or personal banking needs.

You will continue to enjoy the same relationship with our bankers as you always have. We value the relationship you share with your client-facing team and relationship managers, and it is important to us that you continue to work with someone who knows you and your business. Your relationship manager will now be backed by the West’s leading regional bank, providing you with access to additional solutions designed to help you and your business thrive.

You will not see any immediate changes to the services we provide. As the close of the merger approaches, we will share additional information with you. Though there might be minor changes at the merger’s closing, most changes to your accounts and services will not occur until our systems and services transition to those offered by Umpqua Bank, which we expect to occur in early 2026. Umpqua Bank operates many of the same technologies and services you enjoy today, which will help create a smooth transition experience. We will provide you with ample notice of any change to your services, as well as detailed information and support resources well in advance. Up-to-date information about our progress will always be available in the Information Center at UmpquaBank.com/Pacific.

Not at this time. Due to the overlap between some locations in the Northwest, there may be a small number of consolidations. We are currently evaluating the Pacific Premier and Umpqua locations that overlap and expect to share details about any consolidations well in advance.

Not at this time. Until the close of the merger, we remain separate and independent banks, and you may not conduct your Pacific Premier banking at Umpqua Bank. Please continue to visit any of our branch locations. You may begin using Umpqua Bank branches following the close of our merger, which we anticipate will occur later in 2025.

Not at this time. You may not use an Umpqua Bank ATM without incurring fees until the close of the merger. Once the merger has closed, you may use your Pacific Premier ATM or debit card at over 350 Umpqua Bank ATMs across the West without incurring a fee.

Umpqua is changing the name of the bank to Columbia Bank to ensure brand clarity as they expand West and to simplify the bank’s family of brands. The name Columbia Bank aligns with the name of the bank’s holding company, Columbia Banking System, and a variety of other brands the bank operates today, including Columbia Wealth Management, Columbia Trust Company, Columbia Private Bank and Columbia Wealth Advisors.

Umpqua anticipates changing the name later this year. They will provide you with plenty of notice before the date of the name change.

Umpqua does not expect the name change to have an impact on Pacific Premier.

Please contact your relationship manager directly or call us at 855-343-4070.

FORWARD-LOOKING STATEMENTS

This communication may contain certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements about the benefits of the proposed business combination transaction between Columbia Banking System, Inc. (“Columbia”) and Pacific Premier Bancorp, Inc. (“Pacific Premier”) (the “Transaction”), the plans, objectives, expectations and intentions of Columbia and Pacific Premier, the expected timing of completion of the Transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. All statements other than statements of historical fact, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as “expect,” “anticipate,” “believe,” “intend,” “estimate,” “plan,” “believe,” “target,” “goal,” or similar expressions, or future or conditional verbs such as “will,” “may,” “might,” “should,” “would,” “could,” or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

Although there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements or historical performance: changes in general economic, political, or industry conditions, and in conditions impacting the banking industry specifically; uncertainty in U.S. fiscal, monetary and trade policy, including the interest rate policies of the Federal Reserve Board or the effects of any declines in housing and commercial real estate prices, high or increasing unemployment rates, continued or renewed inflation, the impact of proposed or imposed tariffs by the U.S. government or retaliatory tariffs proposed or imposed by U.S. trading partners that could have an adverse impact on customers or any recession or slowdown in economic growth particularly in the western United States; volatility and disruptions in global capital and credit markets; the impact of bank failures or adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks; changes in interest rates that could significantly reduce net interest income and negatively affect asset yields and valuations and funding sources, including impacts on prepayment speeds; competitive pressures among financial institutions and nontraditional providers of financial services, including on product pricing and services; concentrations within Columbia’s or Pacific Premier’s loan portfolio (including commercial real estate loans), large loans to certain borrowers, and large deposits from certain clients; the success, impact, and timing of Columbia’s and Pacific Premier’s respective business strategies, including market acceptance of any new products or services and Columbia’s and Pacific Premier’s ability to successfully implement efficiency and operational excellence initiatives; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations; changes in laws or regulations; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the merger agreement to which Columbia and Pacific Premier are parties; the outcome of any legal proceedings that may be instituted against Columbia or Pacific Premier; delays in completing the Transaction; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the Transaction); the failure to obtain shareholder or stockholder approvals, as applicable, or to satisfy any of the other conditions to the closing of the Transaction on a timely basis or at all; changes in Columbia’s or Pacific Premier’s share price before closing, including as a result of the financial performance of the other party prior to closing, or more generally due to broader stock market movements, and the performance of financial companies and peer group companies; the possibility that the anticipated benefits of the Transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Columbia and Pacific Premier do business; certain restrictions during the pendency of the proposed Transaction that may impact the parties’ ability to pursue certain business opportunities or strategic Transactions; the possibility that the Transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Transaction; the ability to complete the Transaction and integration of Columbia and Pacific Premier promptly and successfully; the dilution caused by Columbia’s issuance of additional shares of its capital stock in connection with the Transaction; and other factors that may affect the future results of Columbia and Pacific Premier. Additional factors that could cause results to differ materially from those described above can be found in Columbia’s Annual Report on Form 10-K for the year ended December 31, 2024, which is on file with the Securities and Exchange Commission (the “SEC”) (available here https://www.sec.gov/ix?doc=/Archives/edgar/data/0000887343/000088734325000054/colb-20241231.htm#i6860d1bb88754f2d85d33ee6bd121966_493) and available on Columbia’s investor relations website, www.columbiabankingsystem.com, under the heading “SEC Filings,” and in other documents Columbia files with the SEC, and in Pacific Premier’s Annual Report on Form 10-K for the year ended December 31, 2024, which is on file with the SEC (available here https://www.sec.gov/ix?doc=/Archives/edgar/data/1028918/000102891825000014/ppbi-20241231.htm) and available on Pacific Premier’s website, investors.ppbi.com, under the heading “SEC Filings” and in other documents Pacific Premier files with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Columbia nor Pacific Premier assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed Transaction, Columbia will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Columbia and Pacific Premier and a Prospectus of Columbia, as well as other relevant documents concerning the Transaction. Certain matters in respect of the Transaction involving Columbia and Pacific Premier will be submitted to Columbia’s and Pacific Premier’s shareholders or stockholders, as applicable, for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. INVESTORS, COLUMBIA SHAREHOLDERS AND PACIFIC PREMIER STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders or stockholders, as applicable, will be able to obtain a free copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about the Transaction, Columbia and Pacific Premier, without charge, at the SEC’s website, www.sec.gov. Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Columbia Banking System, Inc., Attention: Investor Relations, 1301 A Street, Tacoma, WA 98402-4200, (503) 727-4100 or to Pacific Premier Bancorp, Inc., Attention: Corporate Secretary, 17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614, (949) 864-8000.

PARTICIPANTS IN THE SOLICITATION

Columbia, Pacific Premier, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Columbia shareholders or Pacific Premier stockholders in connection with the Transaction under the rules of the SEC. Information regarding Columbia’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Columbia’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 25, 2025 (available here https://www.sec.gov/ix?doc=/Archives/edgar/data/0000887343/000088734325000054/colb-20241231.htm#i6860d1bb88754f2d85d33ee6bd121966_493) ; in the sections entitled “Board Structure and Compensation,” “Compensation Discussion and Analysis,” “Compensation Tables,” “Information about Executive Officers,” “Beneficial Ownership of Directors and Executive Officers” and “Certain Relationships and Related Transactions” in Columbia’s definitive proxy statement relating to its 2025 Annual Meeting of Shareholders, which was filed with the SEC on April 3, 2025 (available here https://www.sec.gov/ix?doc=/Archives/edgar/data/0000887343/000088734325000152/colb-20250403.htm) ; and other documents filed by Columbia with the SEC. Information regarding Pacific Premier’s directors and executive officers is available in the sections entitled “Directors, Executive Officers and Corporate Governance” and “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” in Pacific Premier’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 28, 2025 (available here https://www.sec.gov/ix?doc=/Archives/edgar/data/1028918/000102891825000014/ppbi-20241231.htm); in the sections entitled “Compensation of Non-Employee Directors,” “Security Ownership of Directors and Executive Officers,” “Certain Relationships and Related Transactions,” “Summary Compensation Table,” “Employment Agreements, Salary Continuation Plans, Severance, and Change-in-Control Payments,” and “Summary of Potential Termination Payments” in Pacific Premier’s definitive proxy statement relating to its 2025 Annual Meeting of Stockholders, which was filed with the SEC on April 7, 2025 (available here https://www.sec.gov/ix?doc=/Archives/edgar/data/1028918/000155837025004551/ppbi-20250519xdef14a.htm) ; and other documents filed by Pacific Premier with the SEC. To the extent holdings of Columbia common stock by the directors and executive officers of Columbia or holdings of Pacific Premier common stock by directors and executive officers of Pacific Premier have changed from the amounts held by such persons as reflected in the documents described above, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus relating to the Transaction. Free copies of this document may be obtained as described in the preceding paragraph.